Average Herd Size of Beef Cattle Throughout the Us

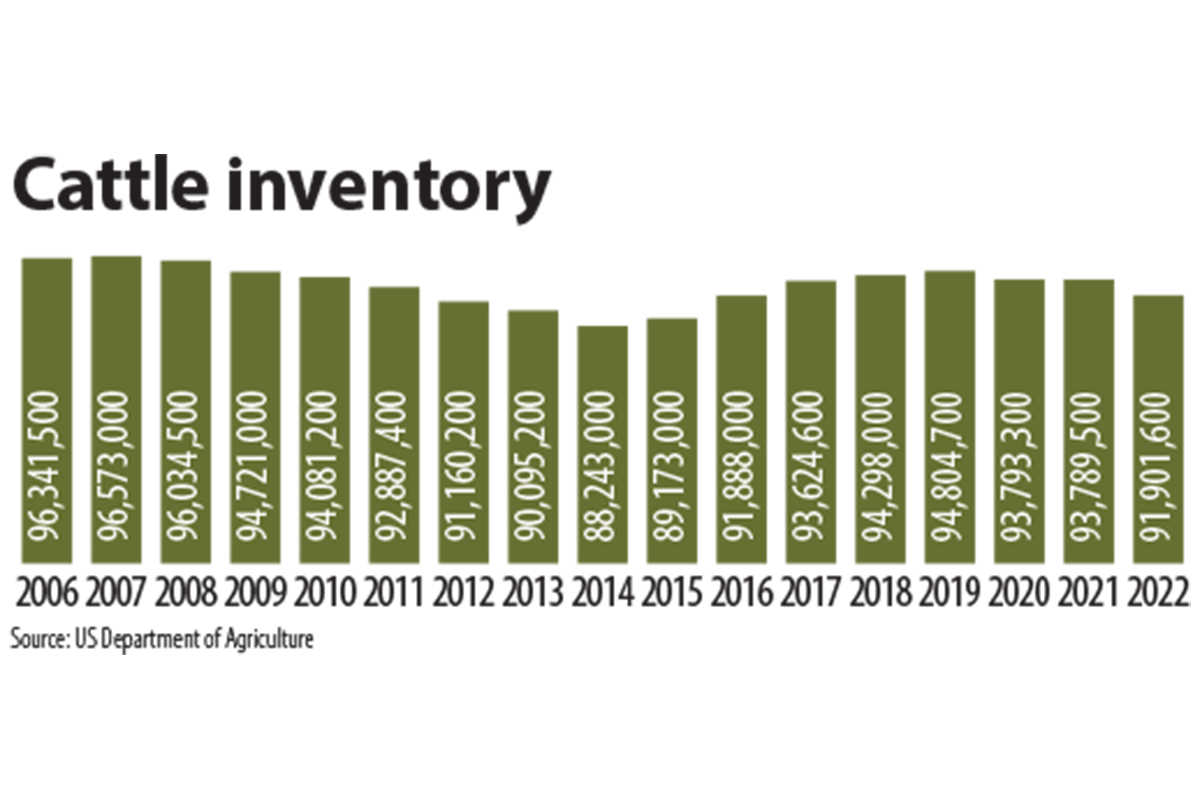

KANSAS Urban center — The U.s. Department of Agriculture in its annual Cattle report issued Jan. 31 estimated the full U.s. cattle herd on Jan. i down 2% from Jan. 1, 2021. The number declined for a 3rd consecutive year and was the smallest since 2016.

The USDA estimated the total herd at 91,901,600 caput, including 30,125,000 beef cows, downward 2.3% from 2021, and 9,375,000 milk cows, down 0.7%. All sub-categories were down from 1% to five% from 2021, except for all cattle on feed Jan. ane at xiv,692,600 caput, up 24,800 caput, or 0.2%.

The USDA inventory data, and industry outlooks, point to declining beefiness cattle numbers and continued stiff exports, which suggests tighter domestic beef supplies and potentially college beefiness prices.

Total cattle numbers "bottomed out" at 88,234,000 head in 2014, the smallest inventory since 1951, then increased to an 11-year high of 94,804,700 caput in 2019 and have declined since. The Us inventory peaked at 132,027,700 head in 1975.

Historically, the cattle herd has risen and fallen in roughly 10-yr cycles (actually 12.eight years between peaks and troughs) since the late 1800s, whether the overall trend in numbers is rising or falling, and the overall trend has been falling since 1975. The cycles primarily are driven by profitability (or loss) for ranchers and cattle feeders, just also take been instigated by droughts and other factors. While cattle herds can be reduced quickly, rebuilding takes several years. Beef supplies increase in the early years of the down part of the cycle as additional animals are sent to packing plants, as seems to be the case currently. Numbers so remain depression early in the rebuilding phase every bit heifers that otherwise would have been slaughtered for meat are held dorsum for convenance. Considering a cow's gestation period is nine months, and it takes a couple years for a heifer to exist ready for breeding and some other 9 months for the heifer to have a calf, the cycle stretches to 10 or nearly xiii years, although in that location have been variations. The USDA Cattle written report estimated the number of beefiness replacement heifers on January. 1 at v.61 million caput, downwardly 3% from a year earlier, indicating the rebuilding phase had non withal begun.

Historically, the cattle herd has risen and fallen in roughly 10-yr cycles (actually 12.eight years between peaks and troughs) since the late 1800s, whether the overall trend in numbers is rising or falling, and the overall trend has been falling since 1975. The cycles primarily are driven by profitability (or loss) for ranchers and cattle feeders, just also take been instigated by droughts and other factors. While cattle herds can be reduced quickly, rebuilding takes several years. Beef supplies increase in the early years of the down part of the cycle as additional animals are sent to packing plants, as seems to be the case currently. Numbers so remain depression early in the rebuilding phase every bit heifers that otherwise would have been slaughtered for meat are held dorsum for convenance. Considering a cow's gestation period is nine months, and it takes a couple years for a heifer to exist ready for breeding and some other 9 months for the heifer to have a calf, the cycle stretches to 10 or nearly xiii years, although in that location have been variations. The USDA Cattle written report estimated the number of beefiness replacement heifers on January. 1 at v.61 million caput, downwardly 3% from a year earlier, indicating the rebuilding phase had non withal begun.

Kevin Skilful, vice president of industry relations and analysis for CattleFax, at the recent 2022 Cattle Industry Convention and National Cattlemen'southward Beefiness Association trade show in Houston noted drought, marketplace volatility and processing capacity challenged cattle producers in 2021 and that without improvement in weather and profitability, numbers would continue to pass up. He predicted commercial beef production would decline for the next several years, starting with a 2% driblet in 2022 due to lower numbers of beefiness cows, feeder cattle and slaughter cattle.

The USDA in its Feb. ix Globe Agricultural Supply and Demand Estimates report raised from January its forecast of 2022 beef production "as larger expected placements (of cattle on feed) during commencement-half 2022 are marketed in the latter half of the year." Beef product in 2022 was forecast by the USDA at 27,375 meg lbs, upwardly 210 1000000 lbs from January but down 562 million lbs, or ii%, from 2021.

Meanwhile, exports remain strong. The US Meat Export Federation said U.s. beef exports were record high in 2021 at one.44 meg tonnes, up 15% from 2020, and worth $ten.58 billion, upwards 38%.

The USDA in its WASDE report estimated Us 2021 beef exports at 3,447 million lbs, up 17% from 2020, but forecast 2022 exports at 3,270 million lbs, down 5%.

CattleFax, meanwhile, expects beefiness exports to jump about 5% in 2022 equally global protein supplies tighten.

That strong demand, both domestic and export, should continue to boost beef prices and profitability for ranchers in the latter half of 2022, and the negative touch from COVID should continue to refuse, which eventually will encourage producers to commencement rebuilding beef cattle herds.

mcconnellbutragreake72.blogspot.com

Source: https://www.foodbusinessnews.net/articles/20725-us-cattle-herd-continues-to-get-smaller

0 Response to "Average Herd Size of Beef Cattle Throughout the Us"

Отправить комментарий